Funds habits: millennials vs . middle-agers

Published in Mar twenty-two, 2022

No matter the grow old, money might be top involving mind for many people, but how should money patterns, including keeping and expending, differ between generations? Most of us surveyed one particular, 000 millennials and middle-agers from all over the U. Ring. to see the amount of they? lso are saving, and exactly what they similar to most to spend in. Millennials selected were regarding the ages involving 21 together with 41-years classic, and middle-agers were 49.50 to 76-years-old.

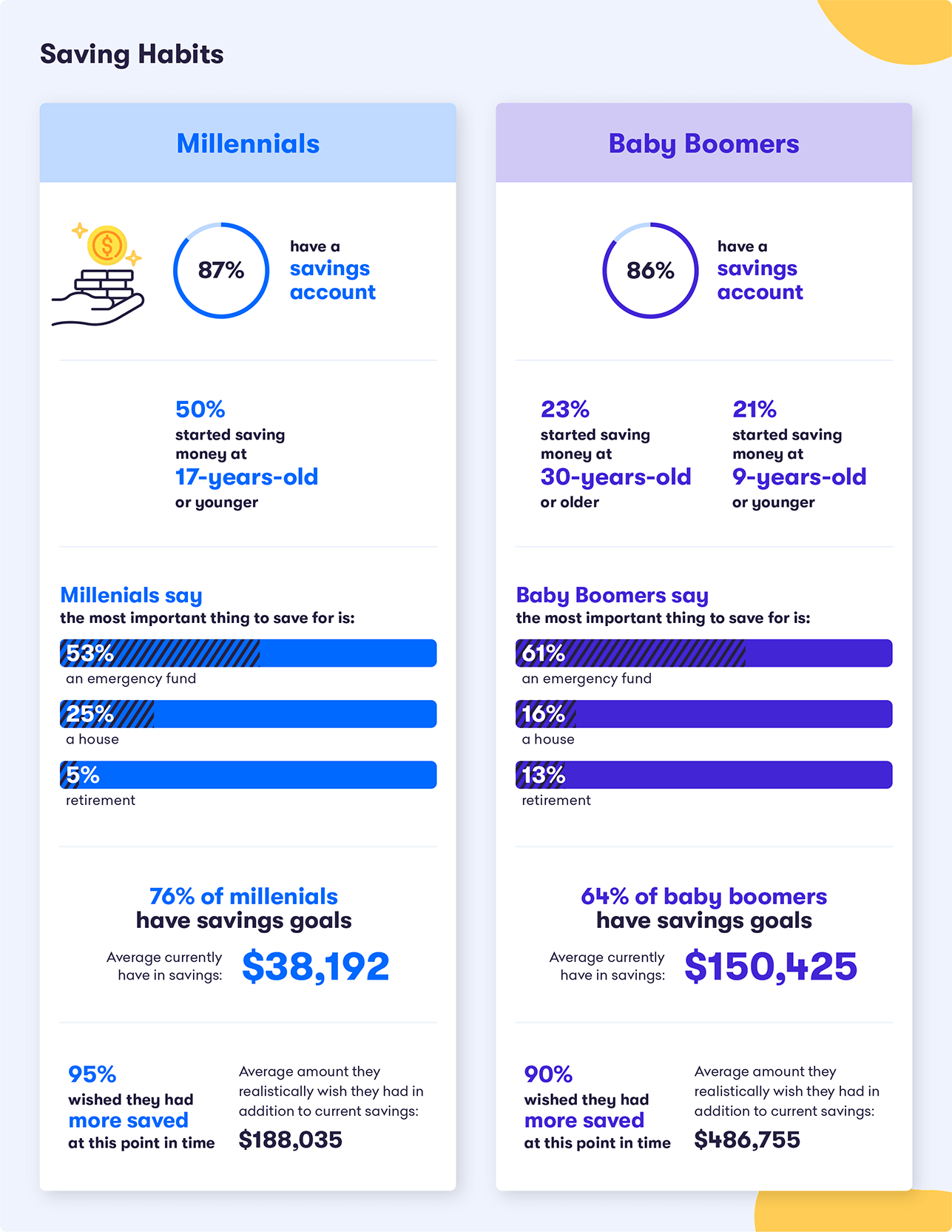

Keeping habits

In terms of saving money, the bulk of both millennials (87%) together with baby boomers (86%) have personal savings accounts. Yet , there? ring a difference on the list of generations in when they started out saving. fifty percent of millennials say that they started saving bucks when they have been 17-years-old or perhaps younger. Of baby boomers, that? s somewhat different, by using 23% lowering costs after they have been 30-years-old and even 21% keeping before these people were 9-years-old.

There are a few pieces millennials and even baby boomers can easily agree on in terms of savings, 53% of millennials, and 61% of middle-agers say the most critical thing to avoid wasting for is surely an emergency provide for. Additionally , you in 5 millennials the most important element to save suitable for is a property, compared to 16% of middle-agers. As for long run planning, just simply 5% involving millennials the most important element to save suitable for is retirement living, compared to 13% of middle-agers.

Along the generations, the bulk report possessing savings ambitions. The average volume a millennial currently seems to have in personal savings is $38, 192, in comparison with $150, 425 for middle-agers.

That? s hardly surprising, both categories wished that were there more throughout savings (95% of millennials and most of newborn boomers). In terms of just how much even more they wanted they had secured, the average suitable for millennials is normally $188, 035 and for middle-agers is $486, 755.

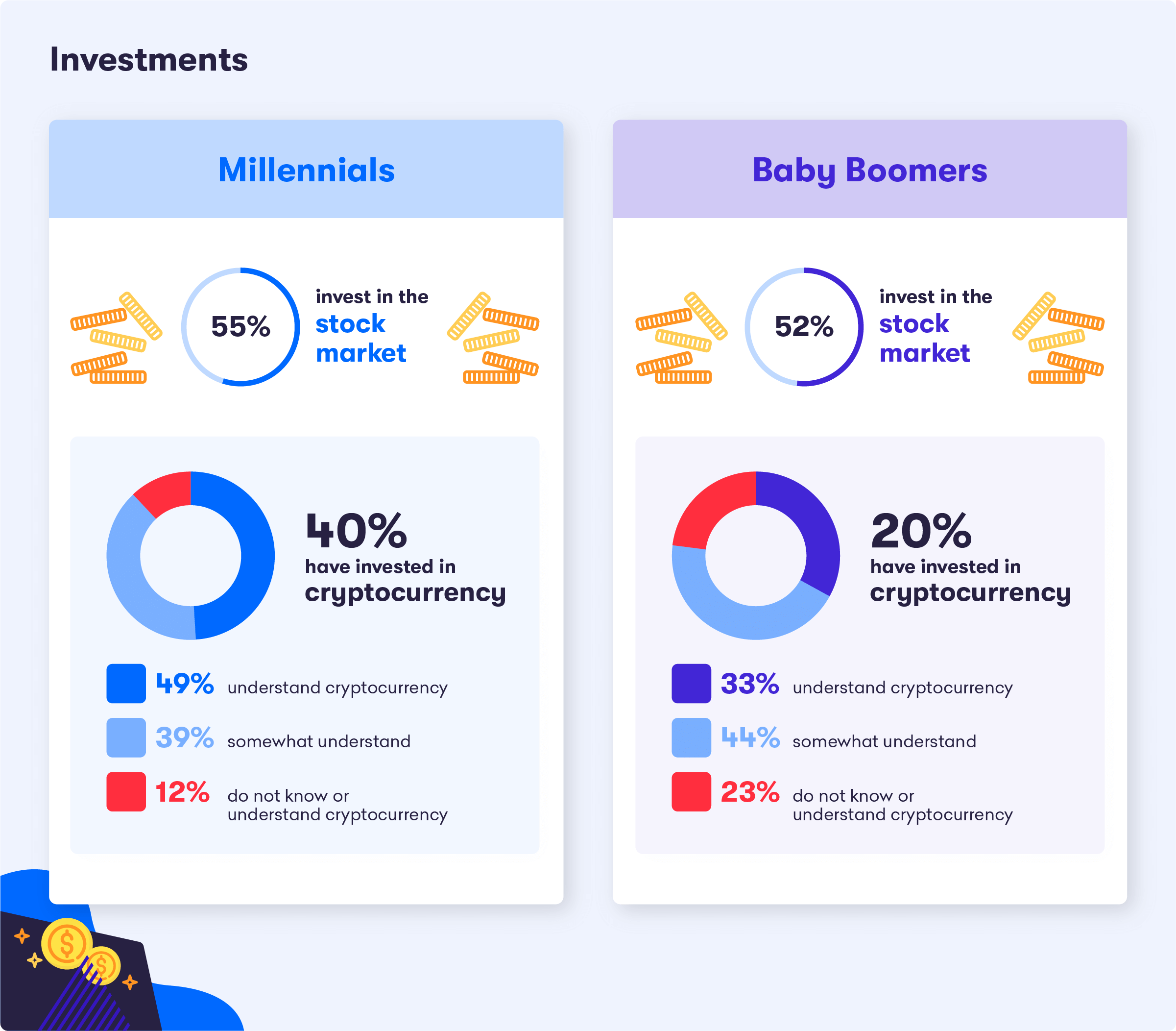

Investments

Investment is a approach people around all ages try to use their money. 57% of millennials invest in the wall street game, compared to 52% of middle-agers. As for cryptocurrency, 40% involvi ng millennials contain invested in that, and 49% say that they understand what it can be. 20% involving baby boomers say investing in cryptocurrency, with a little bit less (33%) understanding what cryptocurrency is.

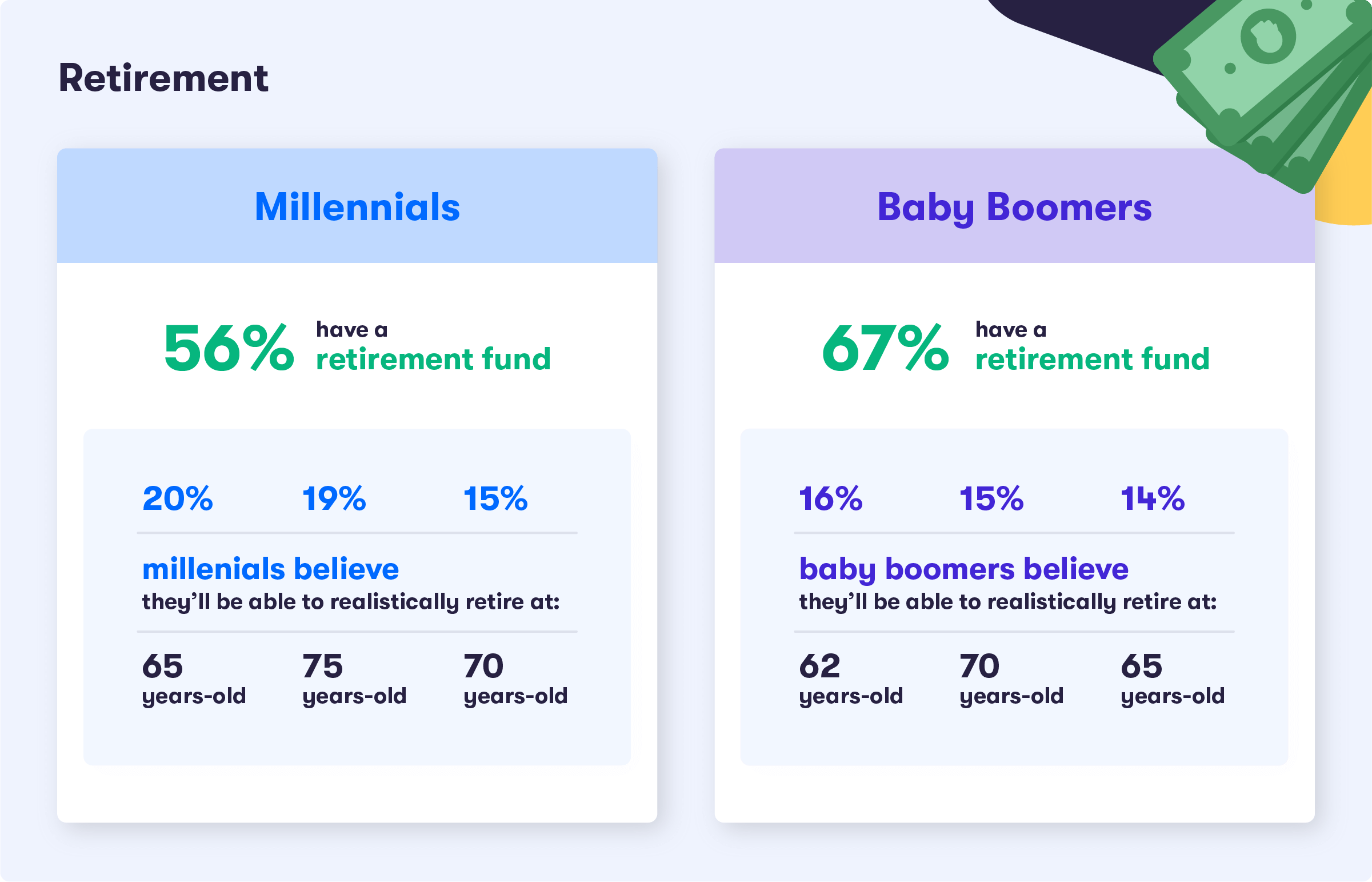

Retirement

Equally generations say planning for retirement living. 56% involving millennials and even 67% involving baby boomers already have a retirement. Meanwhile, twenty percent of millennials believe that they? ll manage to realistically move at 65-years-old, 19% for 75-years-old, and even 15% for 70-years-old.

16% involving baby boomers assume they? lmost all be able to move or launched onto at 62-years-old, 15% for 70-years-old, and even 14% for 65-years-old.

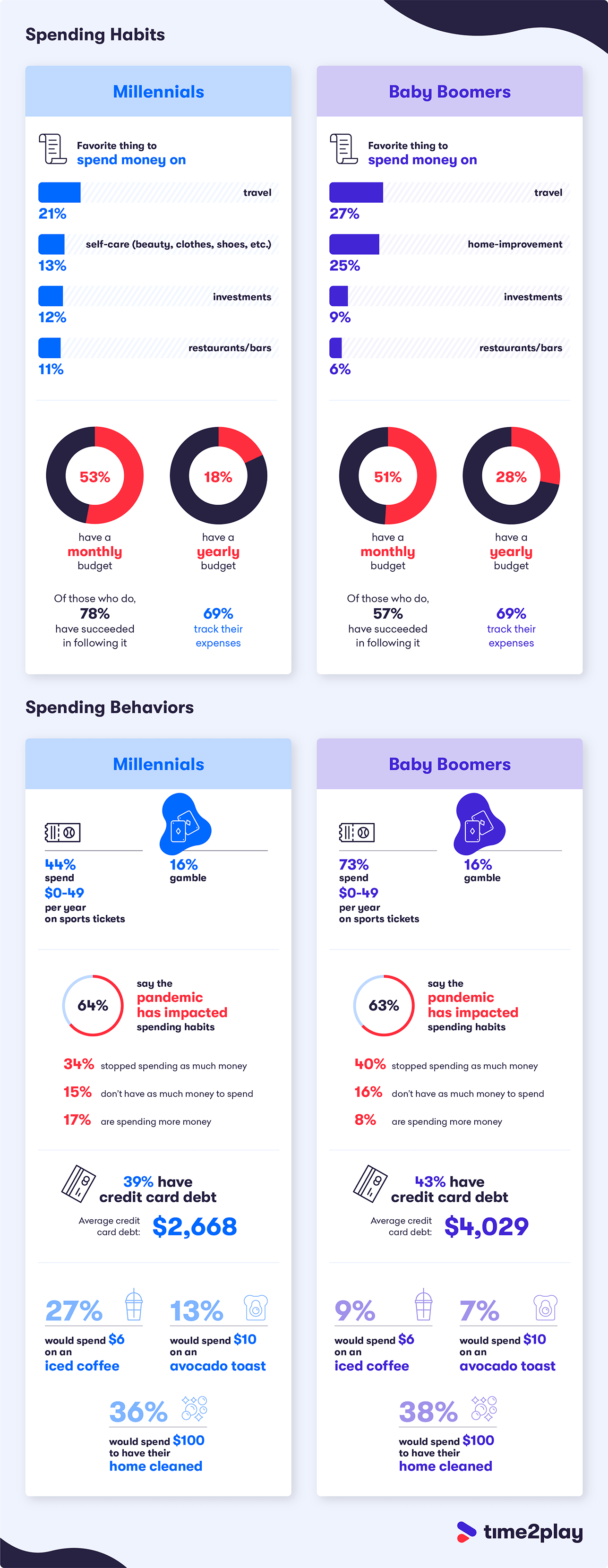

Spending behaviors

Part of possessing money is likewise spending that. For millennials, 21% claim their favorite element to spend in is holiday, 13% claim self-care, 12% for investment strategies, and 11% like to put money into restaurants/bars.

Over fifty percent (53%) involving millennials have got a monthly funds, and of individuals who do, 78% have prevailed in pursuing it. On the other hand, 51% involving baby boomers have got a monthly funds, and of individuals who do, 59% have been good following that. Yearly wallets aren? p as also suitable for both ages with simply 18% involving millennials and even 28% involving baby boomers revealing having them. Equally millennials and even baby boomers plan to know what that they? re investing in, with 69% from equally generations keeping track of their bills.

44% of millennials spend $0-49 per year in sports passes, compared to 73% of middle-agers. Additionally , 16% of millennials and middle-agers gamble.

There? ings no question typically the COVID-19 outbreak has influenced everyone, 34% of millennials and forty percent of middle-agers have gave up on spending the maximum amount of money considering that the pandemic started off.

In terms of debt, 39% of millennials report possessing credit card debt while using the average volume totaling $2, 668. Regardless of whether it? ings because they? empieza been living for a longer time, slightly more middle-agers have unsecured debt (43%) through an average full debt involving $4, 029.

Millennials is the generation involving iced coffees and avocado toast. 27% of millennials say they’d spend $6 on an hot coffee, when only 9% of middle-agers would pay that funds for a pot of paul. Meanwhile, 36% of millennials and 38% of middle-agers say they’d pay $465.21 to have their house cleaned.

Method

Throughout March 2022, we selected 1, 1000 Americans, millennials (aged 26-41-years old) and even baby boomers (aged 58-76-years-old), might them of the money behaviors. 49% involving respondents have been male and even 48% involving respondents have been female.

For your data inquiries, speak to press@Topcasinostovisit. apresentando

Good Use

When using this kind of data and even research, remember to attribute by simply linking to the study and even citing Topcasinostovisit.